The Market Rebounds…PSYCH!

Growing up my sister and I would play a game which had a single sole purpose. Bamboozle the other player. Perhaps some of you may have witnessed it or engaged in it yourselves... The game was was called "psych!"

Here's a scenario:

My sister: Do you want this Popsicle?

Me: Yes.

Just as I was about to grab it, she pulled it away screaming, "Psych!" (multiple times).

It was infuriating!

This game came to mind as market participants poured money into equities believing the Fed would "pivot" its policy on dealing with inflation.

Then came the big PSYCH!... Jackson Hole.

Given the brutal market sell-off that followed I will take a stab and say that Fed chair Powell's comment on fighting inflation will bring "...pain to households and businesses," was not welcome.

In a shameless plug, I should mention we warned to heed caution and not get trapped in the narrative in last month's market update - read here.

What's Next?

Reiterating its aggressive position at Jackson Hole, the Fed signaled that tighter financial conditions and higher rates are in the future.

The question is how long will it keep this path and what is the end result? Soft landing? Crash and Burn? 7% mortgage rates?

It's hard to tell. One thing we do know is that the Fed is determined to slow down the economy. Period. Which is not great for asset prices.

For now, we have to take the Fed at its word and expect the future to be difficult.

But that does not mean another psych! is not right around the corner.

The Fed has kept its openness to a policy shift if the data supports it and there are a plethora of reasons why the Fed may need to abandon its aggressive QT earlier than expected (not all reasons are because of good data either).

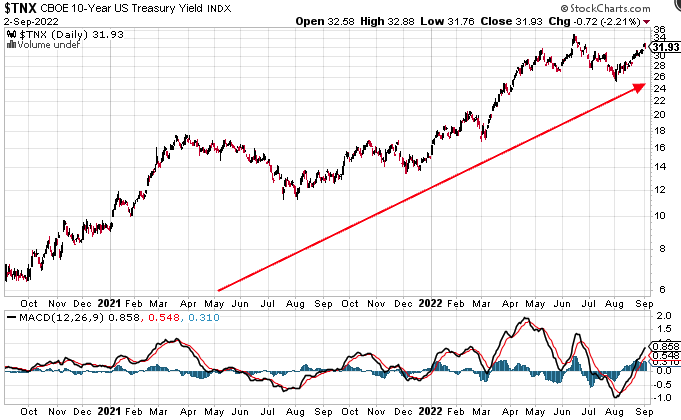

Yet, just as the Fed is data dependent, so are we. One of the best leading indicators as of late has been the 10 year treasury (see chart below). We maintain that a trend change in this indicator may be the early signs of a possible psych! (pivot) in Fed policy.

Conclusion

From bond market liquidity issues, natural disasters, computer chip restrictions, to a European energy crises, there is no shortage of geopolitical and economic fires blazing around the world. As painful as they may be, economic difficulties have a unique way of shifting investment from areas that were long over-invested, to areas of innovation and new opportunities, ultimately making the world a better place.

Perhaps that silver lining may be a ways off, but keeping an eye on treasury yields and Fed rhetoric may hold the key to a change in the current trend.

For now, we maintain our cautious position on the capital markets and continue to hold a significant amount of cash as we assess new opportunities and allow data to drive our decision making.

"There Are Always Flowers for Those Who Want To See Them," - Henri Matisse

Thank you for reading,

James Anadon

Founder | Lead Advisor